Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

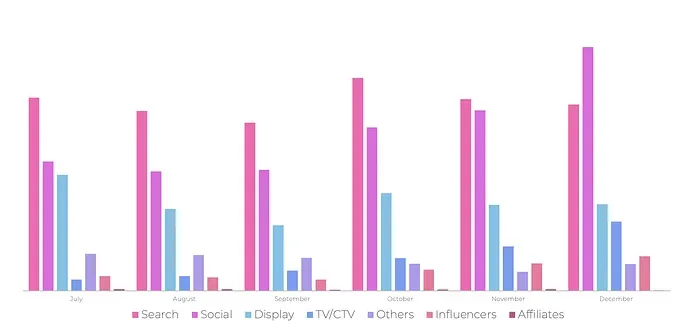

Several weeks ago, we shared an analysis over the number of channels advertisers are active across, finding an obvious correlation between total budgets spent and the number of channels brands were active with.

This time around, we wanted to go deeper by showing which are the most popular channels brands across various verticals are active with.

We’re working with a lot of brands across 19 different verticals (to date) – ranging from mobile free-to-play gaming apps, to advertisers within the health industry who’s customer funnel goes through call centers. The diversity of our customers is extremely wide.

Advertisers working with us spend between <$100K per month to over $30M per month.

We don’t claim to have a data set which represents the entire advertising world – but we do see a large amount of ad spend.

For the sake of this analysis, we bundled customers across all 19 verticals into 6 categories.

Gaming, for example, may include mobile free-to-play, but also AAA gaming companies with products available across the console stores and steam.

eCommerce & retail, for example, may include online shops selling direct to consumer, as well as retailers selling products online and in stores.

General Findings:

Search is the largest medium we see, with Google being the single largest “Channel” across the board, representing just over 30% of the total ad spend we see.

During Q4, Social channels grew substantially overtaking Search during December.

(We believe that Search will continue to dominate the charts in Q1)

We saw the expected jump in TV/CTV as a medium during Q4. This was not surprising.

It was interesting to see that influencer marketing spend has a trend which is similar to that of TV – showing that advertisers sentiment towards influencer marketing.

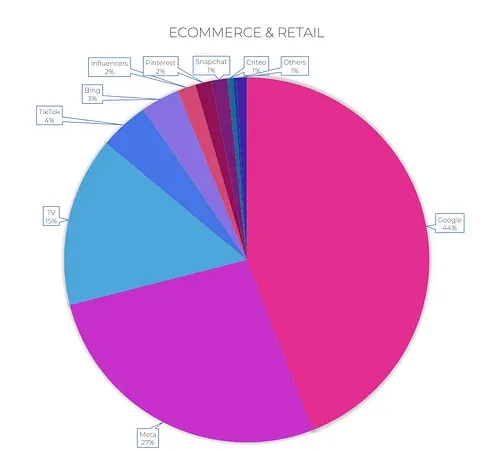

No surprises here. Google is the King for eCommerce advertisers, with smart bidding campaigns, PMAX, and the ability to target intent through Google search.

We did recently publish an analysis over Google’s incremental value for advertisers during Q4 that sheds even more light on Google’s performance..

Many eCommerce and retail advertisers launch TV campaigns during Q4 , trying to spread brand awareness to help boost sales.

Promotions, sales days, special occasions (Black Friday, Christmas) and general consumer sentiment to shop – all drive sales up and the need for proper measurement can make a huge difference in top line revenue as well as profitability.

Advertisers in this space also rely heavily on retargeting strategies—understanding what is retargeting and how it impacts conversion cycles is often key to maximizing ROAS, especially during competitive periods like Q4.

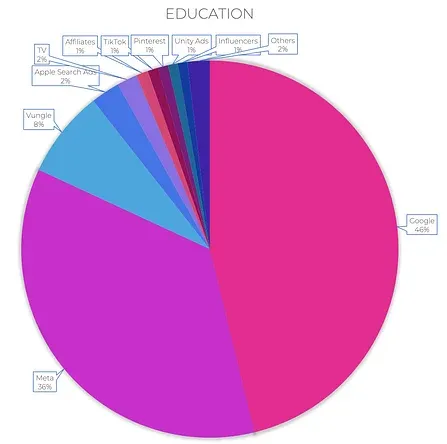

Education is a broad vertical – in which we include online language learning, creative courses, as well as master classes by some of the worlds’ most popular experts in every field. Education could also be apps where kids learn the basics of programming, or students apply to universities online.

Search (Google) was the biggest medium for Education advertisers during Q4, with Social (Meta) not very far out. In general, we see less of a diversification in channels for most education advertisers, where the main effort when it comes to optimization, relies on campaign level tactics, as well as allocating spends amongst various channels across the many countries our customers operate in.

Accurate tracking of ad metrics in this space is crucial, especially as education brands often operate globally and need to evaluate performance at both regional and campaign levels.

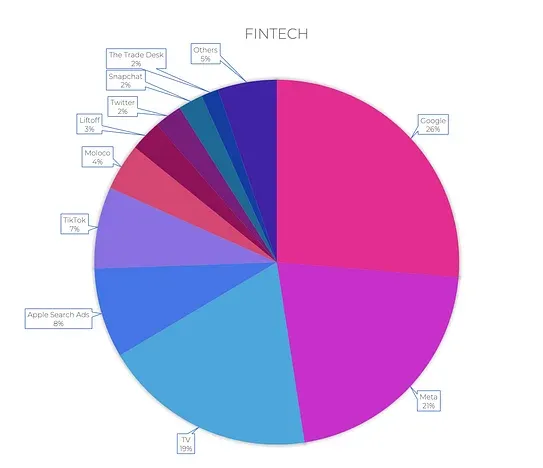

Fintech is another broad term. Fintech advertisers could include eBanks, credit scoring services, Crypto currency wallets, and trading platforms of all sorts.

Here, we could see a significant share of wallet spent across TV. We held a panel about Fintech with experts from Tinuiti, Current, and Tally, who spoke in length about creating consumer trust being an important pillar of the marketing strategy.

TV is a very powerful medium for building trust.

We could also see many Fintech brands investing heavily on brand keywords in search channels such as Google, as well as Apple Search Ads. The Fintech industry is highly competitive, with consumer LTVs reaching thousands – hence, protecting the brand against competitive bidding is crucial for many of the advertisers.

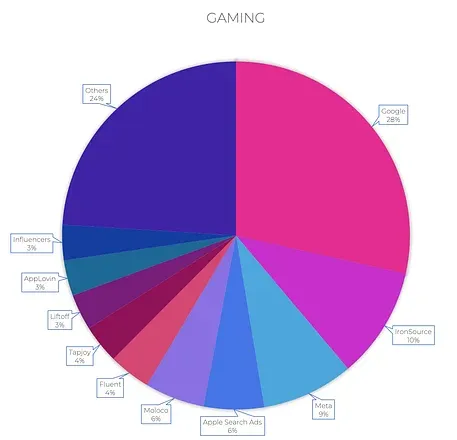

Gaming advertisers were the most diversified. The “Others” bucket includes over 50 different advertising channels: Emulators like BlueStacks, CPE channels such as AdJoe, and DSPs like Kayzen, Smadex, and others

Marketing will often represent the biggest cost for free to play gaming companies, making the need to continuously test new channels extremely important.

There are major differences between gaming companies. Those who operate IP games, using well known characters which appear on movies or TV shows. These would usually enjoy a high % of organic conversions. These gaming companies will often have the challenge of scaling paid advertising without a clear understanding of the true incremental value of paid marketing over organics.

Lesser known games, either casual, hyper casual, RPG, PvP, and others, will often need to operate with dozens of advertising channels, being unable to identify cross channel cannibalization using traditional user-level attribution as a means of measurement.

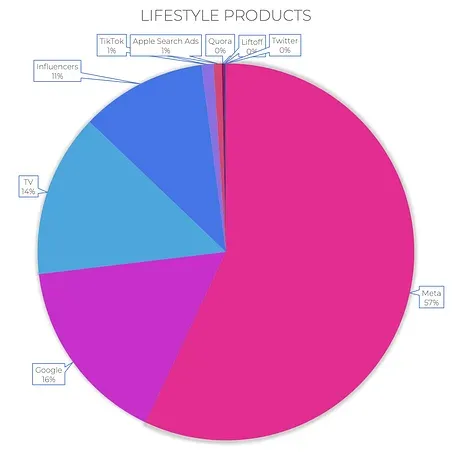

We bucketed several verticals into “Lifestyle” – subscription apps, meditation apps, photography editing, dating, fitness, health related brands, and more.

Here, it was not a big surprise that Meta was the largest single “channel” with Facebook and Instagram included under Meta.

Influencers and TV also play an important part in advertising lifestyle products, as those will often need to find audiences in the right moment.

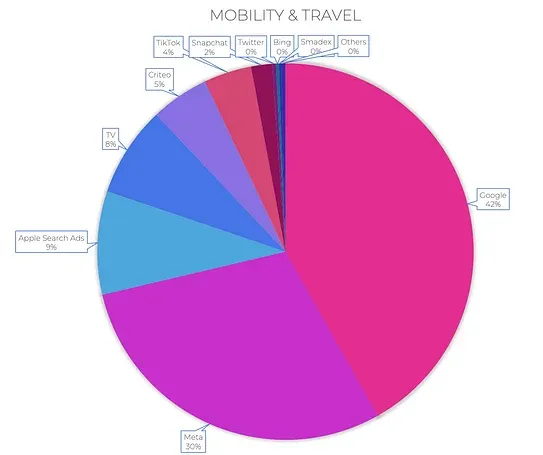

Mobility and Travel both share a critical factor – Seasonality.

The marketing performance of these verticals is highly impacted by annual seasonality patterns related to weather, and holidays.

Q4 for most Travel and Mobility verticals is a “low season” in terms of performance, leading most brands in these verticals to limit their ad spend accordingly.

Important disclaimer: The graphs in no way indicate which are the “best” channels to advertise with. Almost every channel could bring value to one customer, while none to another, be valuable during certain times, and redundant on others. We don’t believe in “performance indexes” as performance is always a relative term. This article is just meant to serve as a showcase for advertisers to get a peek into what other marketing channels other verticals are exploring.