Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Bing has a reputation problem. It gets ignored in budget meetings, treated like an afterthought next to Google, and often dumped into the “we’ll test it later” bucket. But when we look at incrementality results across INCRMNTAL customers datasets, Bing keeps doing something inconvenient for the narrative: it works. (and yes, we are as surprised as you probably are)

This article is based on aggregated patterns across INCRMNTAL customers.

Across the total paid media spend we observe, Bing represents only 0.6% of spend: about $18M out of $3B. By budget share alone you’d assume it barely matters. For some reference - we see more spend on Yahoo (1%), Twitter/X (1.5%), and not to mention Meta (11%) or Google at the top with +23% of all ad spend.

Yet in our incrementality results, Bing shows up as a top tier driver far more often than anyone expects: for 80% of our customers, Bing ranks within the top five performance drivers by incremental impact. We’ve seen mediocre and poor results for less than a handful of advertisers. And no, we can’t find a neat common denominator that explains why it’s exceptional for most but underwhelming for a small minority. That messiness is not a bug - it’s reality, and it’s exactly why we’d never publish a simplistic “index” that pretends one score can predict performance for everyone.

When we say Bing “performs,” we do not mean it generates clicks or looks good in last touch attribution. We mean it drives incremental outcomes: conversions or revenue that would not have happened without the spend. Incrementality asks the only question worth paying for - did this channel change behavior, or did it just take credit for demand that already existed.

INCRMNTAL’s measurement is designed to isolate causal lift at scale rather than rewarding whichever platform happened to be last in the user journey. That distinction matters because channels can look fantastic in attribution while adding very little net new value. So when Bing shows up as a top driver in incremental impact, it is not “present,” it is “productive.”

Clear patterns emerge in the types of advertisers who benefit most. Bing tends to shine with brands appealing to a professional audience - B2B advertisers, and especially PLG marketing teams targeting professionals at work. It also performs strongly for older demographics in B2C, where we frequently see results in categories like financial services, health products, telecom, and lottery products.

Where Bing can underperform is with products designed for younger audiences. We’ve seen weaker results in categories like games and educational products. None of this is a universal law, but it maps to a practical behavioral truth: Bing usage often over-indexes in contexts that are more desktop, more work-oriented, and often older.

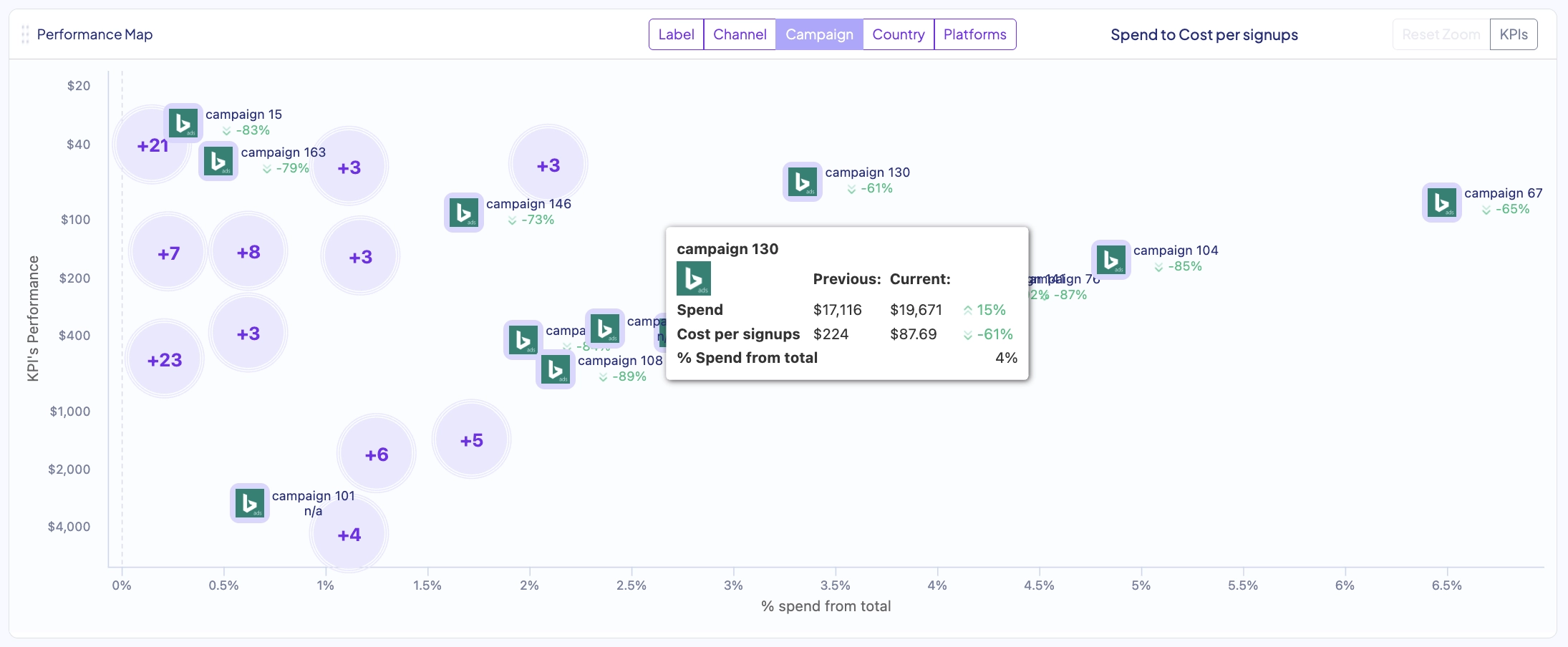

Zoom out and compare advertiser behavior to Bing’s share of the search landscape. StatCounter reports Bing at 4.22% globally, and as high as 16.75% in the US on desktop (November 2025). Given that kind of footprint, you’d expect media plans to allocate a lot more budget there. But in our dataset, the highest share of wallet we’ve seen is just under 4% of an advertiser’s budget, and the median share of wallet is only about 1%.

That gap is the whole story. Underinvestment usually means fewer advertisers fighting in the auction, which often translates to cheaper incremental outcomes and more room to scale before performance degrades. In plain terms: Bing is not only performing well - it is performing well while being under-crowded, which is the combo every marketer claims to want and then somehow forgets exists.

If you’re a brand targeting millennials or older consumers, or you’re a B2B or PLG marketer targeting professionals, and you’re not already investing in Bing, you’re very likely missing incremental value you could be capturing. Test it properly with enough budget to learn something real, judge it on incrementality rather than vibes, and let the data tell you whether you’re in the 80% group where Bing is a top driver - or in the small minority where it isn’t. The only truly bad move is never finding out.

INCRMNTAL is integrated with Bing.