Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

(This article is a deeper dive from out 2026 predictions)

This prediction builds directly on earlier thinking around why retail media works and why it keeps attracting spend: The short version has not changed. Retail media monetizes intent, closes the loop, and does so in a privacy-forward way.

What has changed is how many companies now qualify to play this game.

When Uber announced Uber Ads in Q4 2022 no one asked: “why?”, most asked: “why not sooner?”. Uber generated almost $1bn in revenues the following year, pocketing almost all of that revenue, being one of many companies showing the value in a retail media network.

Retail media networks are no longer a side quest. They are becoming a core growth lever for any business that controls demand, owns a transaction moment, or sits between intent and conversion. In 2026, we are going to see a sharp acceleration in the number and diversity of retail media networks, and not just from retailers as we traditionally define them.

This is not a prediction built on hype. It is a structural outcome of where advertising, data access, and measurement are heading.

Retail media works because it sits at the intersection of three forces that advertisers crave and increasingly struggle to find anywhere else:

1. Targeting real intent

Retail media networks see what people actually want, not just what they browse. Search queries, category views, wishlists, carts, subscriptions, and repeat purchases are signals that outperform almost every proxy the open web can offer.

2. Closed-loop attribution

Retailers can connect ad exposure to real transactions. That makes platform attribution be able to claim conversions without anyone claiming otherwise

3. First-party data at scale

Retail media networks do not need to guess who their customers are. They already know them. That data advantage compounds over time and becomes defensible.

In essence, retail media networks are all about Location, Location, Location!

This is why retail media has been described as irresistible. It monetizes what retailers already have without forcing them to become traditional media companies.

The biggest mistake people make is assuming that retail media networks can only be built by big box retailers or ecommerce marketplaces.

That definition is about to break.

Eric Seufert captured this perfectly with his now-famous thesis that everything is an ad network. His argument is simple and brutal: any company that controls attention, intent, or transactions can monetize that position through advertising.

Once you accept that premise, retail media stops being a category and starts being a pattern. Retail media networks are already popping up in places that would have sounded odd just a few years ago.

A few concrete examples:

• Michaels leaning into in-store and marketplace advertising as part of its handmade ecosystem

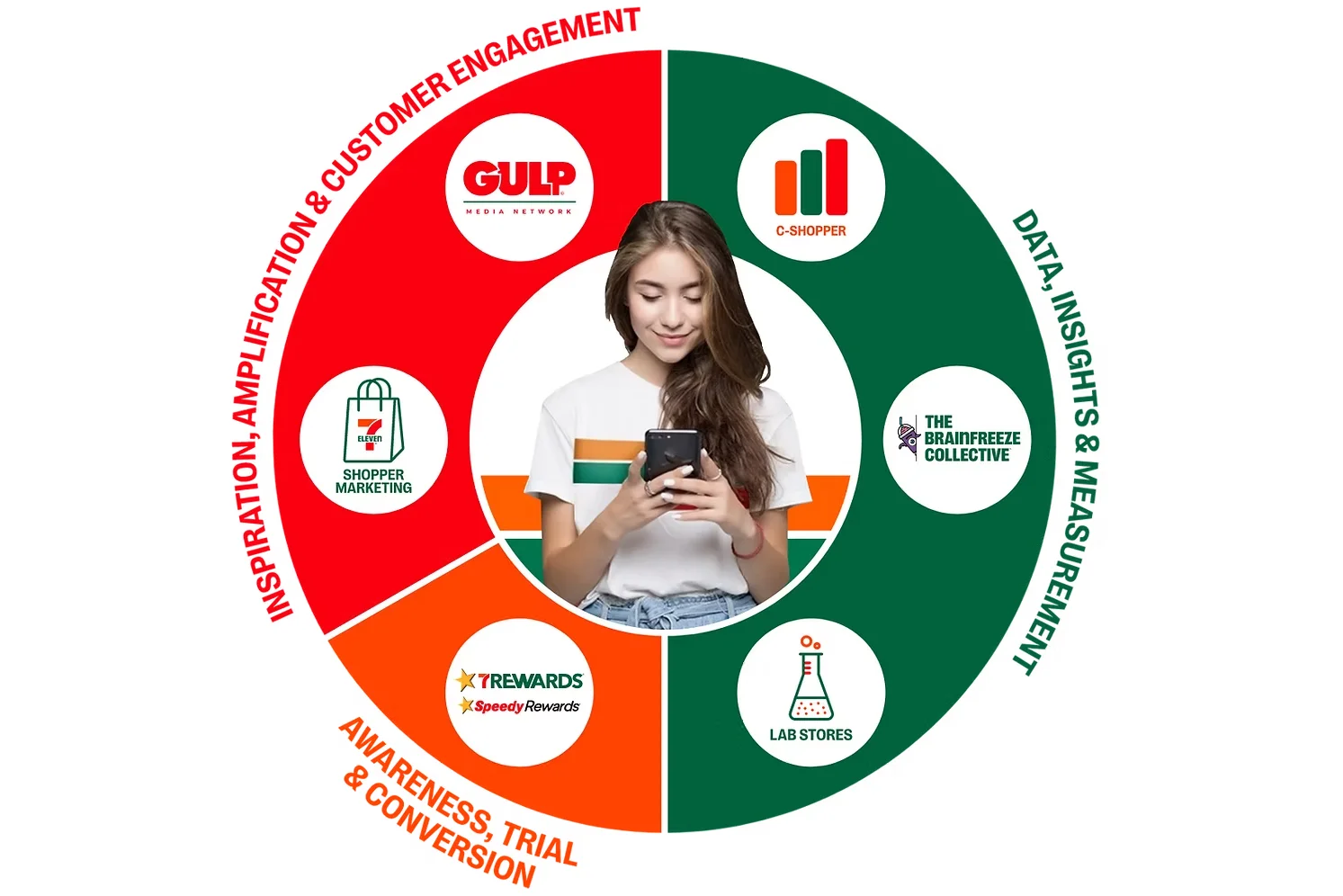

• 7 Eleven (Gulp Media Network), built around commerce-led content and shoppable media

• Mastercard Commerce Media, turning transaction-level insight into a full media and activation layer

These are not edge cases. They are early signals of a much broader shift.

(image source: 7-Eleven, Gulp Media Network “immediate consumption ecosystem”)

With that context, here is where retail media networks can logically emerge next.

Travel and Hospitality Platforms

Airlines, hotel chains, online travel agents, car rental companies, and even small tour operators sit on high-value intent signals. Starting with the knowledge that a traveler is about to make a large purchase, to the knowledge of destination, location, and other parameters that advertisers would (and do!) pay for.

Imagine airlines selling sponsored upgrades, destination experiences, eSims, insurance, or partner offers in a closed environment.

Financial Services and Payments

Banks, credit card companies, buy-no-pay-later providers, and digital wallets see spending behavior before, during, and after the transaction.

They know when you have money for spending, and when you’re in debt. And while they would likely (and hopefully) not sell your data to Advertisers – they can serve you ads for the products that would make the most sense to you at any given point in time.

Telecom and Utility Providers

These companies have visibility into your recurring relationships, and often your entire internet surfing habits. Their understanding of you is persistent. They don’t need to rely on device identifiers, as they have your number. Literally.

The inventory is not banners. It is offers, placements, and contextual promotions embedded in customer journeys.

Marketplaces Beyond Retail

Think about platforms like job boards, real estate portals, education marketplaces, and B2B procurement platforms. Serving you targeted ads that captures users at the right moment creates incremental revenues with minimal effort.

If there is a search box and a decision at the end of it, there is a media opportunity.

Three things converge in 2026:

• Privacy constraints make third-party targeting even weaker

• AI makes campaign personalization and the ability to cast a wide yet targeted net possible

• AI attribution platforms allow advertisers measurement without risking double counts

Retail media offers owned demand, measurable outcomes, and defensibility. That combination is hard to beat.

This matters because retail media networks are not a zero-sum game.

For advertisers, they offer proximity to intent, cleaner measurement, and environments that are closer to the moment of truth than almost any other channel.

For consumers, they can actually improve the experience when done right. Relevant offers beat irrelevant ads. Discovery inside a shopping or decision context feels helpful, not interruptive.

That is why retail media keeps expanding. It creates value on both sides of the equation.

Retail media is not a trend. It is a reallocation of power.

As Eric Seufert argues, everything can become an ad network. In 2026, many companies will finally realize they already are one.

The question is not who can launch a retail media network.

It is why wouldn’t they ?