Platform

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Solutions

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

Use Cases

Many Possibilities. One Platform.

AI and Automation

The Always-on Incrementality Platform

Teams

Built for your whole team.

Industries

Trusted by all verticals.

Mediums

Measure any type of ad spend

(This article is a deeper dive from out 2026 predictions)

CTV works. Period.

In our measurement at INCRMNTAL, and through work with partners like Roku, Universal Ads (Comcast), VIBE, and others, we consistently see incremental impact from CTV. CPAs vary because reality varies: creative, offer, frequency, audience quality, and plain old execution all matter.

So no, this is not a “CTV is broken” post.

This is a “CTV is valuable, and valuable things attract parasites” post.

And in 2026, I expect CTV fraud to get worse before it gets better.

CTV is going to be infested with fraud. It’s actually “great” for INCRMNTAL (since we measure TV incrementality), but it’s REALLY Bad for advertisers, and even worse for legitimate CTV players due to the mistrust fraud creates.

I’m going to make the case in three moves:

1. CTV’s definition problem created the perfect fraud habitat.

2. Attribution is the gasoline that keeps that habitat on fire.

3. Incrementality is the fire extinguisher - and the cleanup crew.

Along the way, I’ll also say the quiet part out loud: if you think you’re buying premium CTV inventory for sub $5 CPM, you’re not buying CTV. You’re fooling yourself.

Imagine buying a car that comes with one working wheel. Actually, forget the wheel. Imagine it comes with a steering wheel that sometimes steers, because the vendor assures you “most people don’t really turn.” 🤦♂️

Or going to a steak restaurant, ordering prime rib by the pound, and getting 95% bone with a smile.

That’s basically how advertisers have been trained to think about media inventory. We buy 1,000 impressions assuming most will be ignored, unseen, or simply ineffective. And we tolerate it because the 5% that works is supposed to pay for the rest.

But here’s the part that’s not “waste.” It’s worse.

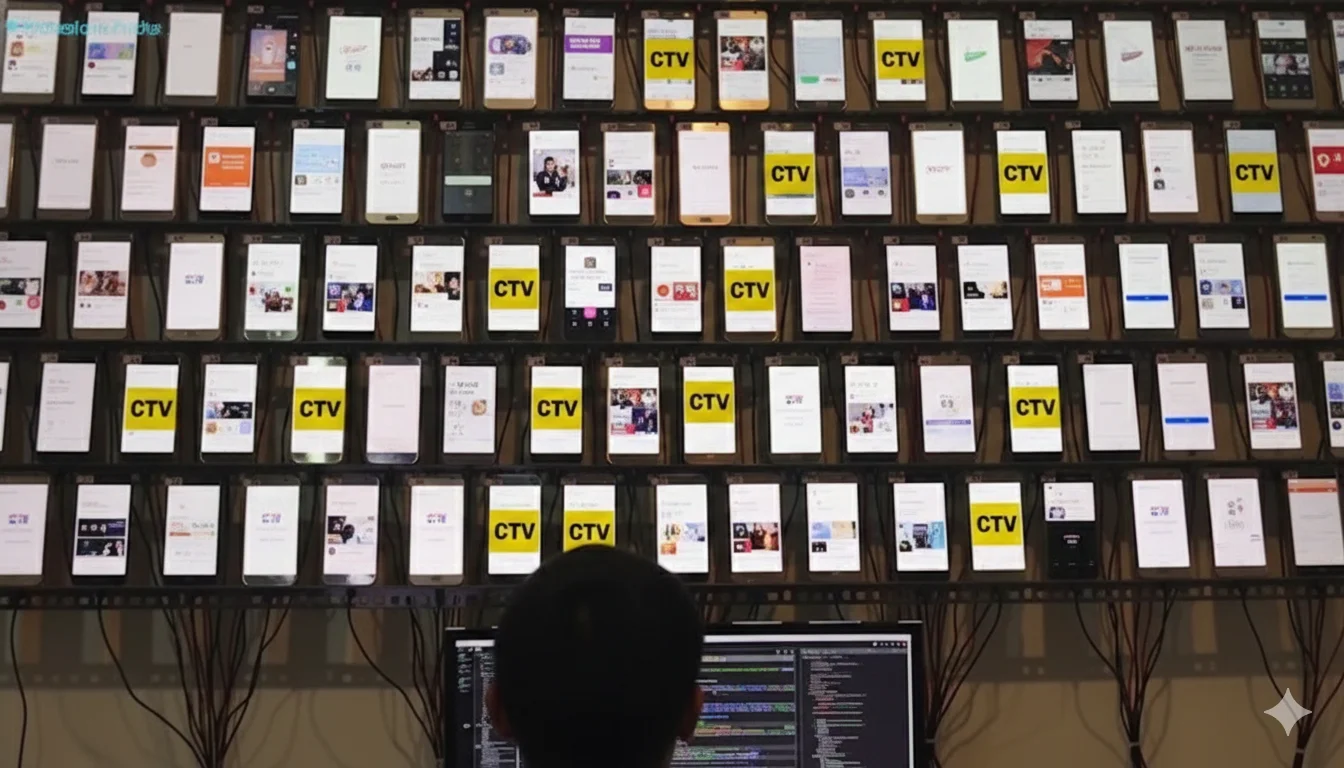

Waste is when humans ignore your ad. Fraud is when no human existed in the first place. Or being sold CTV impressions, but actually getting 320x20 banner impressions disguised as CTV.

Fraud isn’t a glitch in adtech. It’s a feature.

CTV is BOOMING, and as a result, it’s messy, and loosely defined.

CTV is not in testing mode anymore. It’s how people watch. INCRMNTAL’s own CTV industry report summed it up neatly: streaming surpassed cable and broadcast combined in the US, with streaming at 41.4% of total TV viewership as of July 2024 (and that’s based on Nielsen!).

When a new medium gets that kind of budget gravity, two things happen:

• Good marketers show up with real spend.

• Great fraudsters show up with greater PowerPoints.

CTV’s fraud problem isn’t surprising. It’s structurally inevitable, because CTV has a definition crisis. WHAT IS CTV?!

Our own CTV report calls out the blur:

Is Disney+ on a phone “CTV”? Is YouTube on a 75-inch Samsung “CTV”? If someone casts TikTok to a TV, did that TikTok video just become “premium living-room CTV inventory”?

That ambiguity is not just an academic debate. It is the fraudster’s opportunity.

If the industry cannot strictly and consistently define what qualifies as CTV, then “CTV” becomes a label that can be slapped onto:

• non-TV devices

• spoofed devices that pretend they are TVs

• low-quality web or app environments dressed up as “premium streaming”

• duplicated supply sold through stacks of resellers, each taking a cut and adding confusion

In other words: when the definition is squishy, enforcement gets squishy. And when enforcement gets squishy, fraudsters get rich.

Let’s talk about resellers.

Vibe.co published an eye-opening test (read it here): their analysis showed a single ad slot which should have created ±3 bid request generating 500 bid requests. Simultaneously. That’s not normal competition. That’s duplication times 166.

In plain English: the same opportunity gets repackaged again and again, passed through layers, represented by multiple sellers, and presented to buyers as if it’s fresh inventory each time.

Even if there isn’t outright fraud in every one of those bid requests, the conditions are perfect for it:

• transparency drops

• accountability disappears

• verification becomes expensive

• buyers default to trusting logs, labels, and easily forged presentations

And that last part is where we get to the real villain of this story.

Attribution is a scoreboard that can be hacked. It has been hacked, and it will continue getting hacked. Especially in CTV.

Here’s the basic dynamic: attribution assigns credit to touchpoints that can be “connected” to a conversion path. That encourages optimization toward whatever produces measurable signals, not necessarily real impact.

Fraudsters love attribution because attribution rewards:

• cheap signals

• fake device graphs

• suspiciously perfect “post-view” conversions

• inventory that appears to “perform” because it’s engineered to show up near conversion events

Attribution does not ask the most important question: Would the conversion have happened anyway? It asks: Can I attach myself to the conversion so I get paid?

So when advertisers use attribution to measure CTV, they unintentionally create a bounty system:

• “If you can generate a traceable event, you get credit.”

• “If you get credit, you get budget.”

If you’re wondering why “premium CTV” sometimes looks like a miracle machine in attribution dashboards, that’s why.

Attribution is not just vulnerable to fraud. It is an incentive engine for fraud.

Let’s establish a simple heuristic advertisers should tattoo onto their media plans:

If you believe you’re buying a top-tier premium publisher for a CPM that’s wildly below the market, you are not buying a bargain. You are buying fraud.

In CTV, that problem often shows up as:

• spoofed apps and spoofed devices

• misrepresented inventory (“premium channels” that are premium only in the seller’s imagination)

• fake CTV labeled inventory that is not actually on a TV screen

• “arbitraged” placements where the buyer thinks they’re paying for one thing and actually funding another

So yes, “Fake CTV” is going to become a normal term. Not because the industry is dramatic, but because the math gets dramatic when budgets scale.

CTV has reached a tipping point. CTV ad spend is about to surpassed linear TV based on eMarketer. CTV represented 40% of total TV ad spend during 2025, and is expected to hit 50.5% in 2027. Linear TV Advertisers typically do not need to worry about buying TV inventory and getting banners – and as this industry grows, so shell the level of scrutiny.

• Big advertisers are starting to do deeper audits.

• More platforms are tightening supply paths and preferring direct or certified supply.

• OEMs and major CTV ecosystems have more motivation to protect their reputation, especially as regulators and procurement teams get involved.

• Fraud is moving from “annoying” to “material” as CTV budgets become foundational, not experimental.

As per every other medium in digital advertising over the past 25 years – there are five stages in the medium maturity. I’ve personally gone through this twice with Web (i.e. “Desktop”, 2002 - 2011) and Mobile (2011 – 2020). The five stages are:

1. Growth – New innovative medium. Hype level is high. No standards. No clear “leader”.

2. Exploitation – Fraudsters not just celebrate and monetize – they multiply fast.

3. Embarrassment – Someone (large advertiser) reports the problem publicly, or sues someone even more publicly.

4. Standards – Industry outrage. A call for standardization.

5. Consolidation – Clear market winners appear. Consolidation from many players to a market of few.

CTV is moving from 2 to 3. The embarrassment phase is warming up.

Now let’s be very clear so nobody misquotes you into “CTV is trash.”.

CTV is powerful. The problem is not the screen. The problem is the plumbing.

Our own CTV Industry report, based on nearly $2B in ad spend across Q4 2024 and Q1 2025, argues the case that CTV is delivering measurable results across 50+ brands, and it positions CTV as a core driver of outcomes across the funnel.

While results vary wildly based on how CTV is implemented, with advertisers seeing big gaps in CPA and share-of-wallet - which is exactly what you’d expect in a market where some supply is clean and some supply is... let’s call it “not as clean”.

So our stance as INCRMNTAL is not “avoid CTV”, but it is: Stop using a tool that rewards garbage supply as your measurement!

In a roundabout way – CTV Fraud is good for INCRMNTAL’s growth.

Fraud may generate:

• impressions

• device IDs

• view-through metrics

• attribution credit

But it cannot generate incremental lift in real business outcomes at a meaningful, repeatable level. And that’s the point.

Incrementality asks: What changed because of this spend?

Fraud mostly asks: What can I claim because of this spend?

So in a world where “CTV” can be mislabeled, duplicated, or spoofed, incrementality becomes the adult supervision. Not because it’s morally superior. Because it’s impossible to cheat.

If I were advising a CMO who doesn’t want to fund the next generation of fraudsters, I’d tell them this

1) Treat “CTV” as a collection of supply paths, not a checkbox

Stop buying “CTV.” Start buying specific, auditable supply paths.

2) Reduce reseller exposure

If you cannot explain the path from publisher to you in one breath, you are adding risk.

3) Make attribution a diagnostic, not the judge and jury

Attribution can be a directional tool. It should not be your source of truth for CTV.

4) Adopt incrementality as the decision layer

If you want to know what to scale, incrementality is the only measurement that doesn’t collapse under adversarial conditions.

5) Assume the fraud will get worse before it gets better

This isn’t pessimism. It’s just experience. Every high-growth, high-CPM environment gets attacked. Nothing new here.

TV finally became digital and addressable. Each of us can start a CTV campaign within minutes, from the comfort of our laptops. And within days, CTV inherited digital advertising’s favorite tradition: lying with spreadsheets.

The good news is that the clean-up is coming. The better news is that advertisers can get ahead of it by changing the measurement incentives now.

If you keep grading CTV with attribution, you will reward the actors who are best at impersonating performance.

If you grade CTV with incrementality, you’ll reward what actually works.